georgia estate tax laws

Divorce Laws in Georgia. Income tax returns may also be required for the estate itself if it receives income.

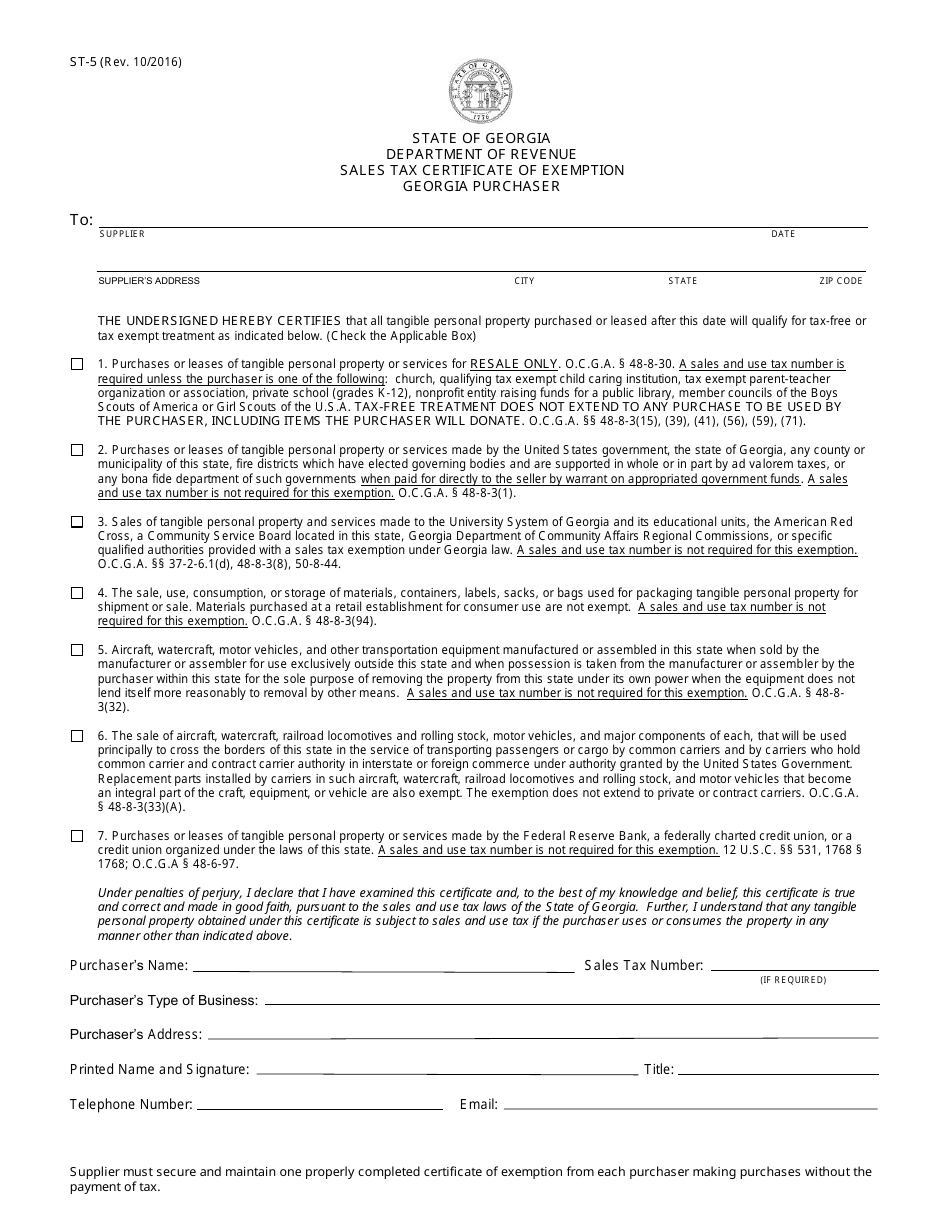

Form St 5 Download Fillable Pdf Or Fill Online Sales Tax Certificate Of Exemption Georgia Purchaser Georgia United States Templateroller

The states sales tax rates and property tax rates are both relatively moderate.

. Senior Citizen Exemptions From Georgia Property Tax If you are 65 years old or older and your net income the previous year wa s 10000 or less you qualify for a 4000 property tax exemption. Connecting communities to funding sources to help build capacity and encourage economic development while honoring the communitys past through historic preservation. The Georgia parking laws under these sections provide provisions for parking on private property including government property when the person is not authorized to park.

Federal estatetrust income tax return. Tennessee repealed its estate tax in. It later turned around and repealed the tax again retroactively to January 1 2013.

Most states including Georgia have homestead protection laws allowing property owners to protect a small parcel of property from creditors and adverse possession laws which allow continuous trespassers to gain title to an otherwise abandoned. This is due nine months after the individuals death though an automatic six-month extension is available if asked for prior to the conclusion of the nine-month period. A marriage can end through an annulment or a divorce in Georgia.

Chatham County makes every effort to assure that the information presented on these web pages are up to date but to obtain the most accurate information you should verify this information with the individual municipality. Less than one percent of estates are expected to have to pay federal estate tax under the current tax structure. Overview of Georgia Retirement Tax Friendliness.

A homestead exemption can give you tax breaks on what you pay in property taxes. Facebook page for Georgiagov. North Carolina also repealed its estate tax on January 1 2010 but it reinstated it a year later.

Property and real estate laws affect renters and landlords as well as home owners or prospective home owners. Learn the specific estate planning documents you need to protect yourself and your loved ones. Local governments adopt their millage rates at various times during the year.

Georgias estate tax for estates of decedents with a date of death before January 1 2005 is based on federal estate tax law. Find out more about the specific laws that affect last wills in Rhode Island how. As of 2022 this is required only.

Michigan has specific laws that affect how a last will ensures your property is correctly handled when you pass away. Filing a property tax return homestead exemptions and appealing a property tax assessment. Call 1-800-GEORGIA to verify that a website is an official website of the State of Georgia.

This is due by April 15 of the year following the individuals death. Welcome to the Georgia Law section of FindLaws State Law collection. Firearms Licenses and Laws.

This section contains user-friendly summaries of Georgia laws as well as citations or links to relevant sections of Georgias online statutesPlease select a topic from the list below to get started. This section provides information on property taxation in the various counties in Georgia. Georgia has no inheritance tax but some people refer to estate tax as inheritance tax.

Rhode Island Last Will and Testament Teaser. There are 13 grounds for divorce in Georgia. Georgia state law allows HOA boards to impose and assess fines and temporarily suspend voting rights and use of commons areas when members fail to comply with HOA covenants.

The Ohio estate tax was repealed as of January 1 2013 under Ohio budget laws. If youre 62 years old or older and living within a school district and your annual family income is 10000 or less then up to 10000 of your. Georgia does not tax Social Security retirement benefits and provides a maximum deduction of 65000 per person on all types of retirement income for anyone 65 or older.

It is not paid by the person inheriting the assets. First offense- no more than 50 second offense- no more than 100. The tax is paid by the estate before any assets are distributed to heirs.

Find out more about the May 02 2022 4 min read. For additional questions about security deposits in Georgia please refer to the official state legislation Georgia Code 44-7-30 44-7-37 for more information. These Georgia parking laws institute specific fines for parking within a private parking area.

Separate maintenance which is similar to legal separation is also allowed and permits couples to decide many of the issues related to a divorce without actually going through the actual divorce itself. LZ Tax Services. The millage rates below are those in effect as of September 1.

Security Deposit Interest in Georgia. Georgias law require security deposits to be deposited into a separate account but the landlord is not required to pay interest on them. A federal estate tax return will be required only if the taxable estate is very largefor deaths in 2022 more than 1206 million.

New Jersey phased out its estate tax in 2018. Georgia has no inheritance or estate taxes. Every effort has been made to include information based on the laws passed by the Georgia Assembly during the previous session.

Federal estate tax return. State laws also require that lot owners and occupants of homes on the lots be allowed access to their properties even while the HOA board assesses fines and other penalties.

Exemption Summary Richmond County Tax Commissioners Ga

Georgia Estate Tax Everything You Need To Know Smartasset

5 Ways The Rich Can Avoid The Estate Tax Smartasset

/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

Georgia Inheritance Laws What You Should Know Smartasset

Georgia Estate Tax Everything You Need To Know Smartasset

Georgia Retirement Tax Friendliness Smartasset

Form St 5 Download Fillable Pdf Or Fill Online Sales Tax Certificate Of Exemption Georgia Purchaser Georgia United States Templateroller

Georgia Retirement Tax Friendliness Smartasset

Let Mestayer Associates P A Handle Your Litigation Whether It Be Estate Tax Law Or Personal Injury Call Now At 228 762 119 Pascagoula Estate Tax Litigation

Georgia Inheritance Laws What You Should Know Smartasset

Create A Living Trust In Georgia Legalzoom Com

Lockheed Martin Workers Fight Against Vax Mandate

Georgia Estate Tax Everything You Need To Know Smartasset

Exemption Summary Richmond County Tax Commissioners Ga

Georgia Retirement Tax Friendliness Smartasset

Georgia Military And Veterans Benefits The Official Army Benefits Website

Georgia State Taxes For 2022 Tax Season Forbes Advisor Forbes Advisor